working capital turnover ratio ideal

As with most financial ratios you should. The company had average working capital of 2 million during the same financial year.

Working Capital Turnover Ratio Meaning Formula Calculation

Therefore its working capital turnover ratio was.

. The working capital turnover ratio is thus 12000000 2000000 60. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

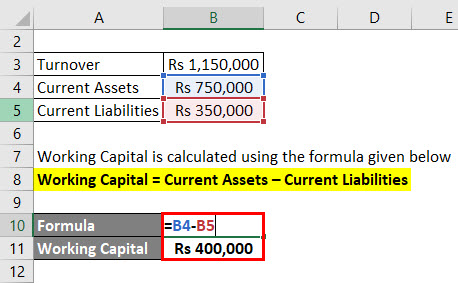

Net sales of 2400000 divided by average working capital of 400000 6 times during the year. It is a measure to define how well the company has made investment in the companys working capital for funding the daily operations and sales. A D V E R T I S E.

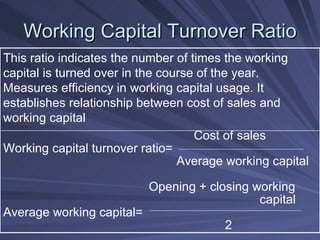

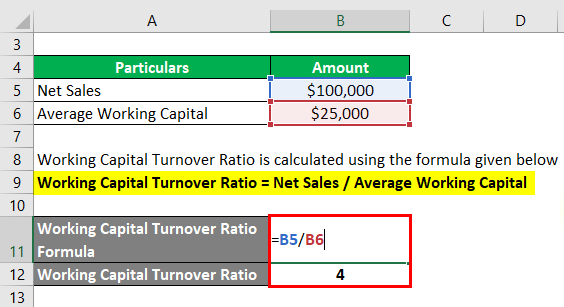

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. WC Turnover Ratio Revenue Average Working Capital. Working Capital Turnover Ratio Formula.

420000 60000. Company As working capital turnover ratio is 10 which means the company spent that 75000 ten times to generate its 750000 in sales. This shows that for every 1 unit of working capital employed the.

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. The activity ratios measure performance of a current asset on the balance sheet against a corresponding area of the income statement. Average Working Capital equals working capital at the start of a period plus working capital at the end of the.

Generally a working capital turnover ratio of 10 means that the company has generated sales. Working Capital Turnover Ratio 288. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times.

Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. The working capital turnover is the. This means that for every 1 spent on the business it is providing net sales of 7.

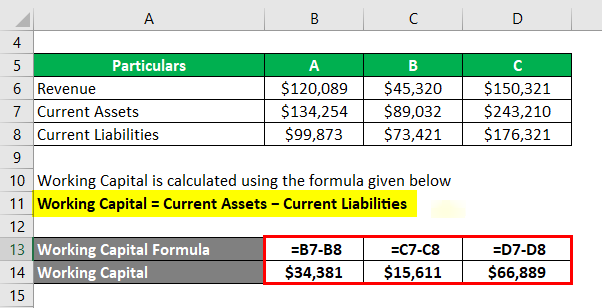

This concludes our article. Working Capital Turnover Ratio 205 4. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

What is the Working Capital Turnover Ratio. So in the case of the given company every dollar of working capital produces 4 of revenue. Jen writes the amounts into the working capital turnover ratio formula which is as follows.

Working Capital Turnover Ratio Net Annual Sales Total Assets Total Liabilities Working Capital Turnover Ratio Examples. Apply Now Get Low Rates. Company B on the other hand had.

Implications of Working Capital Turnover Ratio. Meanwhile the average working capital is calculated by adding up the working capital of the current period with the number in the previous period divided by 2. Use the following working capital turnover ratio formula to calculate the working capital.

The average working capital during that period was 2 million. Working Capital Turnover Ratio Net SalesWorking Capital. Company B 2850 -180 -158x.

Ideally the higher the working capital turnover ratio of the business is the better it is considered. Salescurrent assets - current liabilities or 1000000500000 - 250000 4. Working capital turnover Net annual sales Working capital.

The working capital turnover ratio of Exide company is 214. Working capital Turnover ratio Net Sales Working Capital. Working Capital Turnover Ratio Revenue Average Working Capital.

This means that every dollar of working capital produces. It means each dollar invested in working capital has contributed 214 towards total sales revenue. The formula to measure the working capital turnover ratio is as follows.

For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2. Working capital can be calculated by. Ad Compare Top 7 Working Capital Lenders of 2022.

15000050000 31 or 31 or 3 Times.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Activity Ratio Formula And Turnover Efficiency Metrics

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Efinancemanagement Com

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratios Universal Cpa Review

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Calculator Excel Template

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template